California Wine Regions & Tourism

California wine country is a big draw for luxury travelers, according to a new report from the Wine Institute. Between its stunning fruit-filled vineyards and wealth of standout sips, it’s no secret why California is such a popular destination for wine lovers.

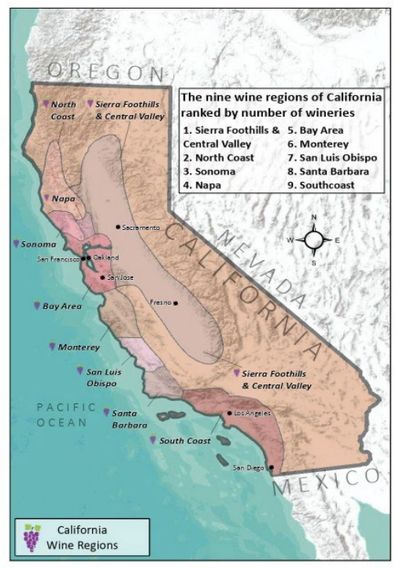

California's wine industry continues to grow, with the number of bonded wineries having increased from 3200+ in 2011 to 4200+ in 2020. To be exact, in 2022, there were 4,876 bonded wineries in California representing 43% of the total number of wineries in the USA.

According to an online survey of more than 2,000 U.S. adults who had recently visited California wine country, nearly 50 percent stayed in luxury hotels (48.3% four-star, 25.6% five-star) versus a national norm of about 15 percent staying in the equivalent of five-star properties.

Visitors use a variety of resources in deciding which regions and wineries to visit and most often rely on word-of-mouth recommendations (62.3%) and general Internet searches (43.9%). While most California wine region trips are driven by leisure vacations (32.6%) or weekend getaways (26.2%), nearly one in ten trips (8.5%) is an add-on to a business or convention trip.

The Wine Institute commissioned the study with support from a USDA grant. It was conducted by Destination Analysts of San Francisco and was fielded in late 2016. In the study, a California wine tourist was defined as someone who had visited a California wine region for leisure within the past three years to capture both high-involvement and casual wine tourists.

American Viticultural Areas (AVAs) in California

In the United States, the legal term for a wine appellation is an American Viticultural Area, or AVA, and corresponds to a unique geographical grapegrowing area that has officially been given appellation status by the Bureau of Alcohol, Tobacco and Firearms (ABC).

Across the Golden State, thousands of acres of new vineyards were planted, and by 1980 the Bureau of Alcohol, Tobacco and Firearms approved and published labeling standards, allowing California to establish viticultural areas based on historical, climatic and geographic characteristics and to feature these areas on wine labels.

Each American Viticulture Area has a distinct “persona” that divides it from the other AVAs. The distinct persona is mainly categorized by climate, geology and elevation. No surprise, Napa Valley is the original California AVA. For a California wine label to display an appellation name, 85% of the fruit in the wine must come from that appellation.

There are 154 American Viticultural Areas (AVAs) in California, a number which is ever increasing. From Mendocino County in the North Coast all the way down to the southern border with Mexico, from coastal regions lining the Pacific Ocean to vineyards flanking the Sierra Nevada foothills, each of the areas boast characteristics that are uniquely their own. These local differences support the cultivation of a wide range of grape varieties and shape a diverse range of wines.

Highlights

The profile of the California wine country visitor is consistent with wine drinker demographics. The average age of visitors to California wine country is 43.9 years old, with Baby Boomers accounting for 39.5 percent, Gen Xers 21.9 percent and Millennials 36.1 percent.

The majority of visitors are married (68.3%), resides in an urban (45.6%) or suburban (44%) area and are slightly more likely to be female (53.7% vs. 46.3%). California wine region visitors are well-educated and have higher incomes compared to the national average leisure traveler.

More than 70 percent of California wine country visitors surveyed drink wine at least once a week with 36 percent drinking wine several times a week and nearly 20 percent imbibing daily. Nearly 60 percent consider wine "important" or "very important" to their lifestyles and see themselves as "very knowledgeable" about the beverage.

About 30 percent have been a member of one or more wine clubs in the past three years, suggesting the potential for growth in wine club sign-ups but also serving as a reminder that while many wine tourists may not join clubs they do purchase wine from other outlets and recommend them to others based on winery visits.

The vast majority of California wine visitors were highly satisfied with their trips and extremely likely to recommend the regions they visited to others. Over 70 percent of surveyed travelers preferred the California wine region they visited to out-of-state wine regions. About 73 percent found that the California wine region visited provided a "better" or "much better" experience.

Residents from outside of the state gave the California wine experience higher ratings than those from California. Nearly 79 percent of travelers from other states gave a top score (8 or above on a 10-point scale), compared to 72 percent of Californians. Finally, visits to a wine region greatly increased the likelihood of purchasing wines from that region when travelers returned home, especially among out-of-state visitors (64% very likely to purchase).

Word of mouth was by far the leading source of information (62%) for deciding what regions to visit, followed by general online search (44%), suggesting that social media and search optimization are very important communications channels for wineries and wine regions. Interestingly, wine magazines edged out travel magazines as an information source, while printed wine region maps came out higher than both (not everything has gone digital).

The survey asked visitors to respond to a series of questions on regions they had visited in the past three years. Based on an analysis of responses, visitors to less well-known or remote wine regions of the state most closely mirror the high-involvement wine drinker versus visitors to more well-known regions.

A higher percentage of visitors to lesser known regions regard wine as important to their lifestyles, are members of wine clubs and consider themselves knowledgeable about wine. This likely reflects both the dedication of high-involvement wine country visitors to seeking out new regions and a larger number of casual visitors to well-known regions–areas of opportunity for both wineries and regions.

Climate & Soil

Have you ever wondered how this sun-kissed state is able to produce such a wide array of high-quality wines? The terroir and geography differ considerably throughout the state, ranging from warm inland valleys to cooler coastal areas.

California winegrowing conditions are governed by proximity to the Pacific Ocean. Cold ocean air turns to fog as it moves up the valleys to cool the land. The cycle of hot days followed by cool, foggy nights lengthens the ripening period and increases the flavor intensity of grapes.

Almost all of the fine wine regions of California are located in areas influenced at least somewhat by the Pacific fog bank. Further inland, consistently hot, sunny areas are used more for fruit and vegetable farming and bulk wine production.

Soils and climates vary substantially throughout California. A complex combination of variables are in play. These include altitude, latitude and proximity to the cool waters of the Pacific Ocean.

In summer, the cold inshore waters of the Pacific help to create a fog bank just off the coast. As the inland air warms and rises, cold fog is sucked in to fill the space. In extreme cases, fog has been known to travel as far as 100 miles (160km) inland, cooling and refreshing the land as it goes. However, mountainous terrain between a vineyard and the Pacific limits the influence of a maritime climate. This relationship can vary widely across the state creating a wide variety of microclimates.

Generally, the cooler regions closer to the coast are better suited to cool climate grape varieties such as Pinot Noir and Chardonnay. Further inland where the climate is much hotter, some of California's most famous red wine is made from Cabernet Sauvignon. Zinfandel produces some outstanding examples throughout the state.

Takeaways

While the premium wine business showed continued success in 2022, overall wine consumption showed a second year of negative growth. Future sales weigh on the industry’s ability to appeal to a new generation of consumers.

Consumers younger than 60 have a lower share of wine consumption compared to what they did in 2007. Consumers older than 60 are the population bands where there is still growth.

While older consumers are paying more for premium wine, younger buyers are increasingly less engaged with the wine category because 35% of 21–29-yearold consumers drink alcohol, but not wine. That number drops 7 percentage points to 28% for individuals 50–59 years old. Of those consumers who left that group, two percentage points moved to being at least marginal wine consumers. Meanwhile, five percent are now abstaining from drinking alcohol.

Copyright © 2025 California Winery Guides - All Rights Reserved.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.